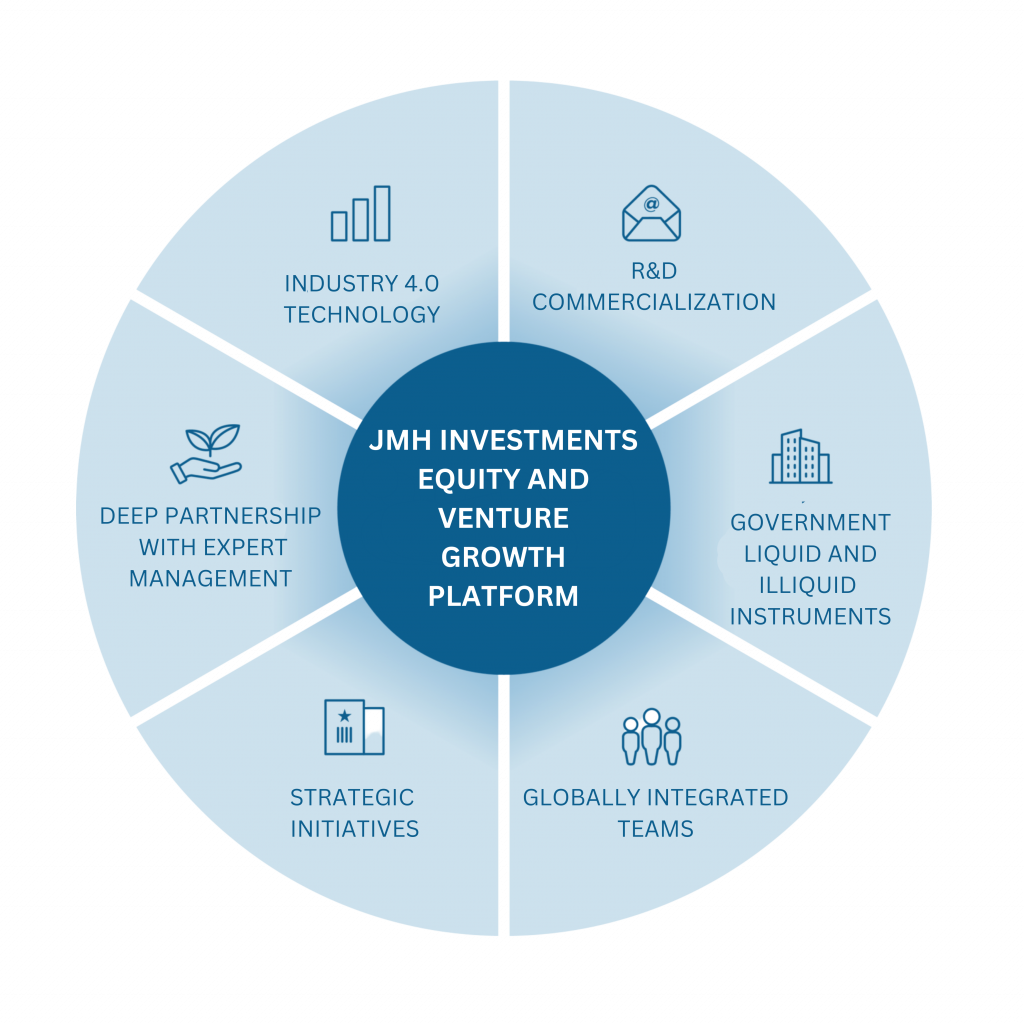

Our firm's investment strategies center around diverse regions and market sectors, blending conventional private equity with distinctive opportunities for special situations. In addition to an extensive network of industry experts, and flexible capital provided to growth-oriented businesses, we are stage-agnostic, from seed to late stage across multiple industries.

A novel approach to availing creative capital against illiquid and liquid sovereign debt & Co-invest. We recognize the distinct opportunity present within the emerging markets credit universe despite its complexity and volatility. Our team of experienced investors/managers has a proven track record of successfully identifying attractively priced creditworthy and distressed debt instruments. Utilizing a bottom-up, fundamental approach to credit analysis, we leverage JMH platform and external network of local bankers, asset managers and advisors to availing capital to Sovereigns (on a project basis). As pioneers in these markets, we have been investing in emerging markets since their inception, and we continue to apply our expertise and comprehensive understanding of the markets to provide our clients with the best possible outcomes.

Equity and debt solutions provided to businesses ranging from seed to late stage, across various industries. Our experienced team of investment professionals are equipped to assess the unique needs and potential of each business, and provide tailored solutions to help them achieve their goals. We work closely with our portfolio companies to provide them with the necessary resources and support to grow and succeed. With a track record of success across multiple industries, we have the expertise to help businesses at every stage of their journey.

JMH specializes in providing growth buyouts and distressed solutions for businesses where we can have control or significant influence. In addition, we also provide non-control healthy special situations, stressed, and distressed solutions to help businesses navigate challenging situations. Our experienced investment professionals employ a rigorous approach to assess each opportunity and tailor solutions to meet the unique needs of the business. With a focus on unlocking value and driving growth, we work closely with management teams to provide the necessary resources and support to achieve success.

Target Business sectors

JMH adopt an industry-focused approach to develop distinct perspectives for our investment decisions. Our approach involves a comprehensive analysis of long-term trends, segment fundamentals, and our own unique experiences. By combining these factors, we aim to gain a deep understanding of the industries we invest in and uncover new investment opportunities that align with our long-term investment objectives.

Industrial

-

- Specialty Chemicals

- Building Products

- Fluid Power Products

- Manufacturing

- Safety Equipment

- Inspection Services

- Industrial Services

- Value-Added Distribution

- Testing, Inspection & Certification

- Automotive & Marine

Services

-

- Engineering

- Environmental

- Recycling (Bio-degradable)

- Facilities Services

- Fixed Based Operators (FBO)

- Restoration & Remediation

-

Transportation & Logistics

-

Asset / Wealth Services & Software

- Pharma Services

Retail

-

- Consumer Products

- Outdoor Products & Recreation

- DTC & Ecommerce

- Health & Wellness

- Residential Services

- Consumer Data

-

Indirect Consumer/B2B2C

-

Education Services

-

Outsourced Hospitality,

-

Travel & Leisure

Engagements Parameters

we place great value on building transparent, candid, respectful, and cooperative partnerships with our portfolio companies. We leverage the experience and expertise of our network of operating executives and resources, many of whom we have established relationships with through previous transactions. In every investment, we demonstrate our strong commitment by investing substantial personal capital alongside our limited partners and co-investors. As individual owners of the company, we approach business issues and management decisions with a long-term perspective, striving to create value and drive growth for our investors and partners.

Platform Investments

Firm Size

-

-

- $2.5 million to $1.5 billion of revenue

- $1million to $1 billion of EBITDA

- Add-On of any size

-

-

-

- Up to $1 billion per transaction

-

-

-

- 100% Buy-outs

- Majority Recapitalizations

- Corporate Carve-outs

- Management Buy-Outs (MBO’s)

-

Transactional Features

-

- Innovative companies with a distinctive product and/or value proposition that have achieved success in their respective markets.

- Established companies with a proven track record of generating earnings and exhibiting strong potential for growth.

- Competent management teams that are open to collaboration in expanding the business.

- Companies with potential for growth through the implementation of strategic, financial, operational, and human resources expertise.

- Companies where existing ownership or management is looking to exit the business entirely or transition to new roles within the company, which we can accommodate.